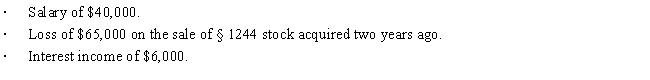

John files a return as a single taxpayer. In 2016, he had the following items:

Determine John's AGI for 2016.

A) ($5,000) .

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

Correct Answer:

Verified

Q12: Dick participates in an activity for 90

Q26: Lucy owns and actively participates in the

Q33: A qualified real estate professional is allowed

Q38: If an owner participates for more than

Q41: Last year, Lucy purchased a $100,000 account

Q42: Peggy is in the business of factoring

Q50: On September 3,2015,Able,a single individual,purchased § 1244

Q53: On February 20,2015,Bill purchased stock in Pink

Q54: Jed is an electrician. Jed and his

Q76: Which of the following events would produce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents