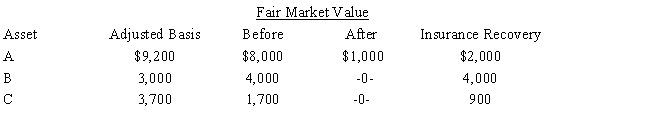

In 2016, Wally had the following insured personal casualty losses (arising from one casualty) . Wally also had $42,000 AGI for the year before considering the casualty.

Wally's casualty loss deduction is:

A) $1,500.

B) $1,600.

C) $4,800.

D) $58,000.

E) None of the above.

Correct Answer:

Verified

Q28: Chris receives a gift of a passive

Q33: Kim dies owning a passive activity with

Q49: Three years ago, Sharon loaned her sister

Q50: On September 3,2015,Able,a single individual,purchased § 1244

Q54: Jed is an electrician. Jed and his

Q56: Two years ago, Gina loaned Tom $50,000.

Q60: On June 2,2015,Fred's TV Sales sold Mark

Q69: Bruce, who is single, had the following

Q72: On July 20,2015,Matt (who files a joint

Q80: Jim had a car accident in 2016

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents