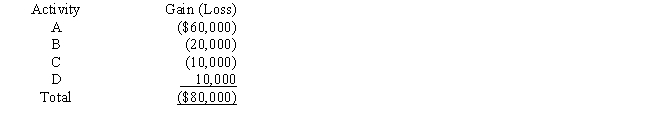

Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Identify how the passive loss rules broadly

Q90: Ken has a $40,000 loss from an

Q106: A taxpayer who sustains a casualty loss

Q107: Discuss the tax treatment of nonreimbursed losses

Q111: Pat sells a passive activity for $100,000

Q114: Vail owns interests in a beauty salon,

Q118: Lindsey, an attorney, earns $125,000 from her

Q125: Discuss the treatment given to suspended passive

Q127: Describe the types of activities and taxpayers

Q131: Lloyd, a life insurance salesman, earns a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents