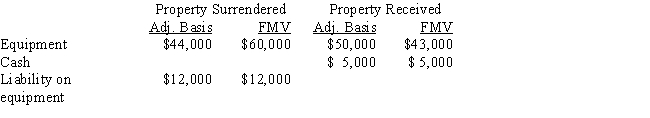

Sammy exchanges equipment used in his business in a like-kind exchange. The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: During 2016,Howard and Mabel,a married couple,decided to

Q63: Jared,a fiscal year taxpayer with a August

Q65: Sam's office building with an adjusted basis

Q92: Chaney exchanges a truck used in her

Q99: As part of the divorce agreement, Tyler

Q183: If the taxpayer qualifies under § 1033

Q198: A factory building owned by Amber, Inc.

Q225: Which of the following types of exchanges

Q228: Which of the following statements is correct

Q234: For the following exchanges, indicate which qualify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents