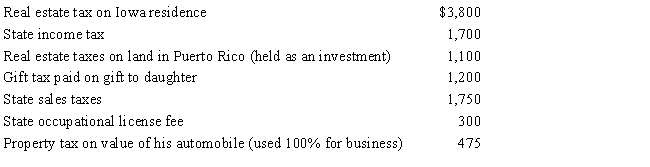

During 2016, Hugh, a self-employed individual, paid the following amounts:

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $6,600

B) $6,650

C) $7,850

D) $8,625

E) None of the above

Correct Answer:

Verified

Q21: A taxpayer may qualify for the credit

Q24: The education tax credits (i.e., the American

Q27: Child and dependent care expenses include amounts

Q30: Qualifying tuition expenses paid from the proceeds

Q33: The maximum credit for child and dependent

Q51: Expenses that are reimbursed by a taxpayer's

Q62: Rick and Carol Ryan, married taxpayers, took

Q74: In 2016,Boris pays a $3,800 premium for

Q79: Brad, who would otherwise qualify as Faye's

Q81: Zeke made the following donations to qualified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents