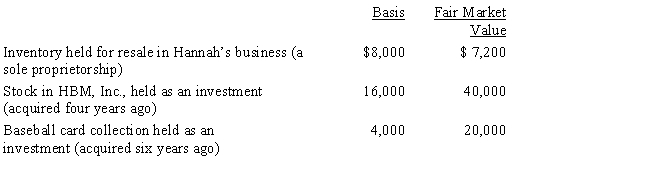

Hannah makes the following charitable donations in the current year:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

A) $28,000.

B) $51,200.

C) $52,000.

D) $67,200.

E) None of the above.

Correct Answer:

Verified

Q55: Olaf was injured in an automobile accident

Q58: The taxpayer is a Ph.D.student in accounting

Q62: Under the alimony rules:

A)To determine whether a

Q77: Which of the following is not a

Q84: Thelma and Mitch were divorced. The couple

Q85: Under the terms of a divorce agreement,

Q93: Tim and Janet were divorced. Their only

Q96: Karen, a calendar year taxpayer, made the

Q96: The alimony rules:

A)Are based on the principle

Q98: Which of the following items would be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents