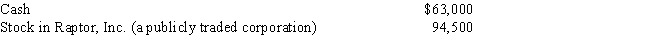

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

A) $56,700

B) $63,000

C) $94,500

D) $157,500

E) None of the above

Correct Answer:

Verified

Q27: Child and dependent care expenses include amounts

Q53: A scholarship recipient at State University may

Q56: Jena is a full-time undergraduate student at

Q62: Rick and Carol Ryan, married taxpayers, took

Q63: Byron owned stock in Blossom Corporation that

Q67: Pedro's child attends a school operated by

Q74: Travis and Andrea were divorced. Their only

Q79: Brad, who would otherwise qualify as Faye's

Q81: Zeke made the following donations to qualified

Q82: Under the terms of a divorce agreement,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents