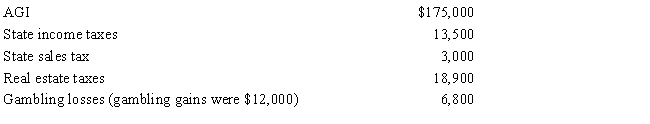

Paul, a calendar year married taxpayer, files a joint return for 2016. Information for 2016 includes the following:

Paul's allowable itemized deductions for 2016 are:

A) $13,500.

B) $32,400.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Q53: A scholarship recipient at State University may

Q67: Pedro's child attends a school operated by

Q68: In the current year, Jerry pays $8,000

Q74: Travis and Andrea were divorced. Their only

Q77: Which of the following is not a

Q82: Under the terms of a divorce agreement,

Q84: Thelma and Mitch were divorced. The couple

Q85: Under the terms of a divorce agreement,

Q93: Tim and Janet were divorced. Their only

Q95: Under the terms of a divorce agreement,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents