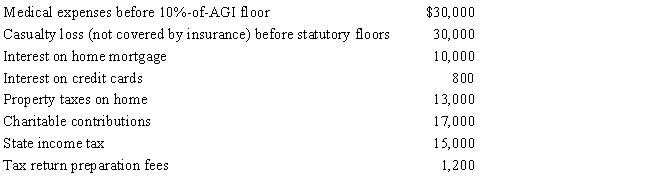

For calendar year 2016, Jon and Betty Hansen (ages 59 and 60) file a joint return reflecting AGI of $280,000. They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Ross, who is single, purchased a personal

Q89: Diane contributed a parcel of land to

Q90: Linda, who has AGI of $120,000 in

Q91: Assuming a taxpayer qualifies for the exclusion

Q105: Bradley has two college-age children,Clint,a freshman at

Q106: Joe, who is in the 33% tax

Q108: Ted and Alice were in the process

Q120: Early in the year, Marion was in

Q123: Charles, who is single and age 61,

Q125: Barbara was injured in an automobile accident.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents