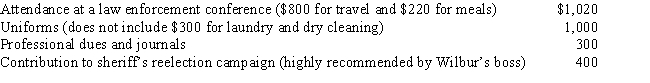

For the current year, Wilbur is employed as a deputy sheriff of a county. He has AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: George is employed by the Quality Appliance

Q105: Lily went from her office in Portland

Q108: Susan generated $55,000 of net earnings from

Q113: Margaret is trying to decide whether to

Q118: Cathy takes five key clients to a

Q166: Noah moved from Delaware to Arizona to

Q169: Paul is employed as an auditor by

Q171: Meredith holds two jobs and attends graduate

Q173: Rod uses his automobile for both business

Q174: In the current year, Bo accepted employment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents