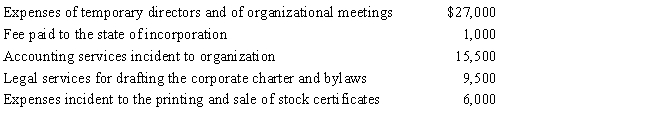

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2016. The following expenses were incurred during the first tax year (April 1 through December 31, 2016) of operations.

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2016?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Correct Answer:

Verified

Q2: In a § 351 transfer, a shareholder

Q11: Tina incorporates her sole proprietorship with assets

Q19: Similar to the like-kind exchange provision, §

Q20: Similar to like-kind exchanges, the receipt of

Q74: Eagle Corporation owns stock in Hawk Corporation

Q78: Orange Corporation owns stock in White Corporation

Q79: Which of the following statements is correct

Q80: Copper Corporation owns stock in Bronze Corporation

Q81: During the current year,Skylark Company had operating

Q91: Schedule M-1 of Form 1120 is used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents