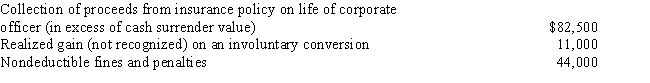

Silver Corporation, a calendar year taxpayer, has taxable income of $550,000. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, Silver Corporation's current E & P is:

A) $500,500.

B) $588,500.

C) $599,500.

D) $687,500.

E) None of the above.

Correct Answer:

Verified

Q43: Tungsten Corporation, a calendar year cash basis

Q55: Cedar Corporation is a calendar year taxpayer

Q60: On January 2, 2016, Orange Corporation purchased

Q70: Which of the following statements is incorrect

Q74: Robin Corporation, a calendar year taxpayer, has

Q76: Pheasant Corporation, a calendar year taxpayer, has

Q79: Tern Corporation, a cash basis taxpayer, has

Q79: Stacey and Andrew each own one-half of

Q80: Tracy and Lance, equal shareholders in Macaw

Q91: Seven years ago, Eleanor transferred property she

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents