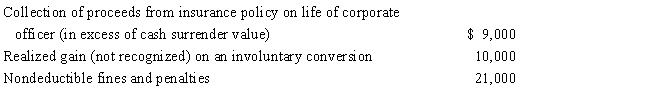

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2017. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q152: Maria owns 75% and Christopher owns 25%

Q154: Sylvia owns 25% of Cormorant Corporation. Cormorant

Q162: Briefly discuss the rules related to distributions

Q165: Gold Corporation has accumulated E & P

Q167: In general, how are current and accumulated

Q168: Provide a brief outline on computing current

Q171: What is a constructive dividend? Provide several

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Q177: Briefly describe the rationale for the reduced

Q179: Steve has a capital loss carryover in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents