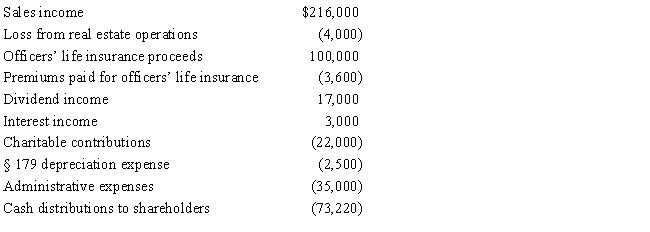

Towne, Inc., a calendar year S corporation, holds AAA of $627,050 at the beginning of the tax year. During the year, the following items occur.

Calculate Towne's ending AAA balance.

Correct Answer:

Verified

Q103: Stock basis first is increased by income

Q112: Separately stated items are listed on Schedule

Q115: In the case of a complete termination

Q126: Since loss property receives a _ in

Q132: Depletion in excess of basis in property

Q133: Alomar, a cash basis S corporation in

Q138: Chris, the sole shareholder of Taylor, Inc.,

Q138: Pepper,Inc.,an S corporation in Norfolk,Virginia,has revenues of

Q140: Estella, Inc., a calendar year S corporation,

Q141: Individuals Adam and Bonnie form an S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents