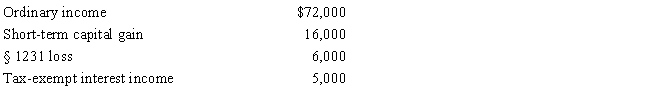

Gene Grams is a 45% owner of a calendar year S corporation during the tax year. His beginning stock basis is $230,000, and the S corporation reports the following items.

Calculate Grams's stock basis at year-end.

Correct Answer:

Verified

Q108: _ husband and wife must consent to

Q108: An S corporation's LIFO recapture amount equals

Q109: An S corporation recognizes a on any

Q113: If any entity electing S status is

Q123: Bidden, Inc., a calendar year S corporation,

Q125: Realized gain is recognized by an S

Q126: Distribution of loss property by an S

Q128: You are a 60% owner of an

Q130: Non-separately computed loss _ a S shareholder's

Q135: On December 31, 2016, Erica Sumners owns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents