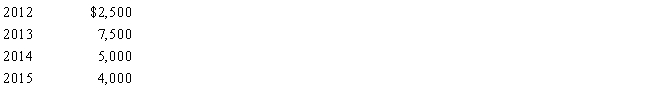

Molly has generated general business credits over the years that have not been utilized. The amounts generated and not utilized follow:

In the current year, 2016, her business generates an additional $15,000 general business credit. In 2016, based on her tax liability before credits, she can utilize a general business credit of up to $20,000. After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2016 is available for future years?

A) $0.

B) $1,000.

C) $14,000.

D) $15,000.

E) None of the above.

Correct Answer:

Verified

Q21: AMTI may be defined as regular taxable

Q26: Because passive losses are not deductible in

Q36: Cher sold undeveloped land that originally cost

Q38: The ACE adjustment can be positive or

Q39: A negative ACE adjustment is beneficial to

Q50: Roger is considering making a $6,000 investment

Q55: During the year, Green, Inc., incurs the

Q56: C corporations are not required to make

Q57: The AMT exemption for a corporation with

Q65: In March 2016,Gray Corporation hired two individuals,both

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents