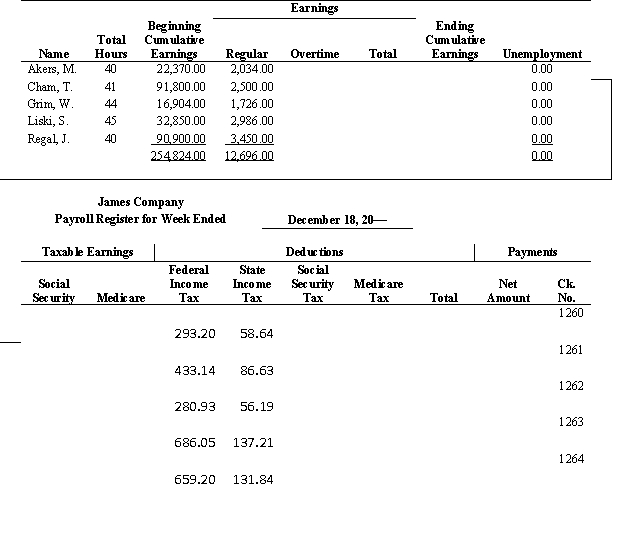

James Company has the following payroll information for the week ended December 18:

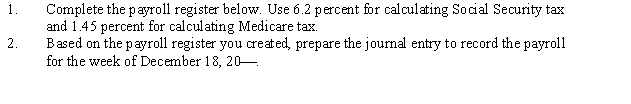

Taxable earnings for Social Security are based on the first $106,800. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week.

Taxable earnings for Social Security are based on the first $106,800. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week.

Instructions:

Correct Answer:

Verified

Q81: Match the terms below with the correct

Q82: Match the terms below with the correct

Q84: The journal entry for recording the payroll

Q85: Explain the similarities and differences in the

Q92: Match the terms below with the correct

Q94: Match the terms below with the correct

Q97: Explain the difference between gross and net

Q101: T. Powell, an employee of Daisy's Day

Q102: Define taxable earnings, how they relate to

Q103: Alpine Homes has the following payroll information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents