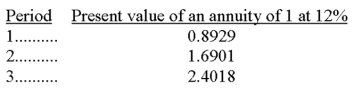

A company is considering the purchase of new equipment for $45,000. The projected after-tax net income is $3,000 after deducting $15,000 of depreciation. The machine has a useful life of 3 years and no salvage value. Management of the company requires a 12% return on investment. The present value of an annuity of 1 for various periods follows:

What is the net present value of this machine assuming all cash flows occur at year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: A company has a decision to make

Q129: A company is considering a proposal to

Q130: Bower Co. is reviewing a capital investment

Q131: A company is considering a 5-year project.

Q133: A company is considering two alternative investment

Q134: Fields Company currently manufactures one of its

Q135: A company can buy a machine that

Q136: A company is considering two projects, Project

Q137: A company is evaluating the purchase of

Q150: A company must decide between scrapping or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents