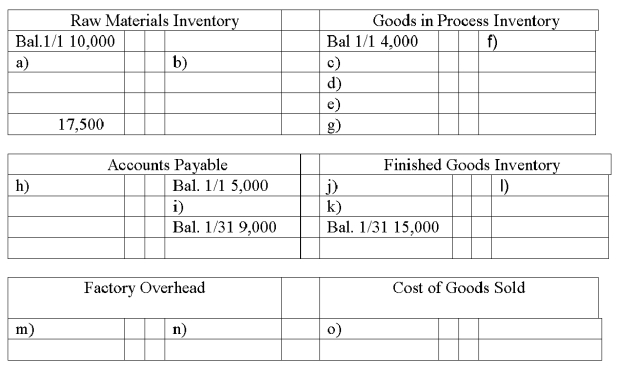

Medlar Corp. maintains a Web-based general ledger. Overhead is applied on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable is used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead allocation rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Fill in the missing amounts a through o above in the T-accounts above.

Correct Answer:

Verified

Q118: Hancock Manufacturing allocates overhead to production on

Q119: Using the following accounts and an overhead

Q120: Describe the use of the Factory Payroll

Q121: The Terrapin Manufacturing Company has the following

Q122: A company uses a job order cost

Q124: Prepare journal entries to record the following

Q125: A company's ending inventory of finished goods

Q126: A company that uses a job order

Q127: Dina Corp. uses a job order cost

Q128: The production of one unit of Product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents