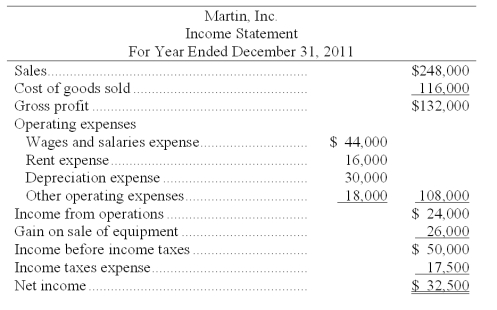

Martin, Inc.'s, income statement is shown below. Based on this income statement and the other information provided, calculate the net cash provided by operations using the indirect method.

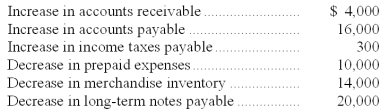

Additional information:

Beginning income taxes payable + Income taxes expense - Cash paid for taxes = Ending income taxes payable

Beginning income taxes payable + Income taxes expense - Cash paid for taxes = Ending income taxes payable

Cash paid for taxes = $17,200

Correct Answer:

Verified

Q134: Match each of the following items with

Q135: A company had average total assets of

Q137: Based on the following income statement and

Q139: Use the following income statement and information

Q141: A company reported net income of $112,000,

Q171: Explain the purpose and format of the

Q189: Explain how cash flows from investing and

Q192: Explain how the cash flows from operating

Q194: Describe the format of the statement of

Q200: Define the cash flow on total assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents