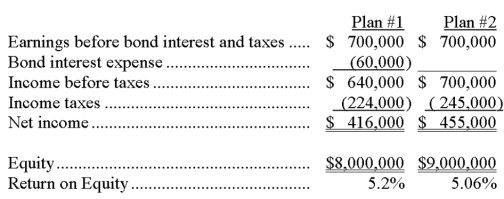

A corporation plans to invest $1 million in oil exploration. The corporation is considering two plans to raise the money. Under Plan #1, bonds with a contract rate of interest of 6% would be issued. Under Plan #2, additional ordinary shares would be issued at $20 per share. The corporation currently has 300,000 shares outstanding, and it expects to earn $700,000 per year before bond interest and income taxes. The net income and return on investment for both plans is shown below:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: On January 1, a company issues bonds

Q116: Match each of the following terms with

Q117: Explain the amortization of a bond premium.

Q118: On January 1, a company issues bonds

Q121: A company issued 9.2%, 10-year bonds with

Q124: A company enters into an agreement to

Q125: A company issues bonds with a par

Q170: Explain the present value concept as it

Q184: A company issued 10-year, 9% bonds with

Q206: On January 1, Year 1 a company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents