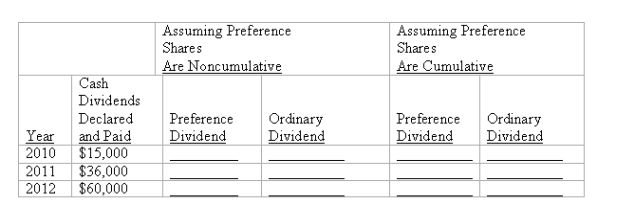

A company was organized in January 2010 and has 2,000 $100 par value, 10%, nonparticipating preference shares outstanding and 30,000 $10 par value ordinary shares outstanding. It has declared and paid cash dividends each year as shown below. Calculate the total dividends distributed to each class of shareholder under each of the assumptions given.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q157: A company is authorized to issue 50,000

Q158: What are the journal entries recorded for

Q159: What are the rights generally granted to

Q161: A company has $100,000 of 10% noncumulative,

Q163: A company reported net income of $478,000

Q164: A company has 500,000 ordinary shares authorized,

Q165: A corporation has $1,750,000 in shareholders' equity

Q166: A company paid a cash dividend of

Q167: A company reported $990,000 in net income

Q180: What is a corporation? Identify the key

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents