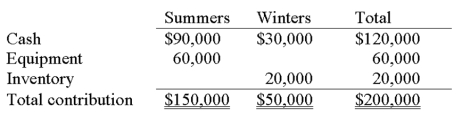

Summers and Winters formed a partnership on January 1. Summers contributed $90,000 cash and equipment with a market value of $60,000. Winters' investment consisted of: cash, $30,000; inventory, $20,000; all at market values. Partnership net income for year 1 and year 2 was $75,000 and $120,000, respectively.

1. Determine each partner's share of the net income for each year, assuming each of the following independent situations:

(a) Income is divided based on the partners' failure to sign an agreement.

(b) Income is divided based on a 2:1 ratio (Summers: Winters).

(c) Income is divided based on the ratio of the partners' original capital investments.

(d) Income is divided based on interest allowance of 12% on the original capital investments; salary allowance to Summers of $30,000 and Winters of $25,000; and the remainder to be divided equally.

2. Prepare the journal entry to record the allocation of the Year 1 income under alternative (d) above.

Part 1: Calculation of partners' capital contributions:

Correct Answer:

Verified

Q101: Conley and Liu allow Lepley to purchase

Q102: Suze and Bess formed the Suzy B

Q103: Armstrong plans to leave the FAP Partnership.

Q104: Juanita invested $100,000 and Jacque invested $95,000

Q105: Paul and Peggy's company is organized as

Q107: Paco and Kate invested $99,000 and $126,000,

Q108: Alberts and Bartel are partners. On October

Q109: Armstrong plans to leave the FAP Partnership.

Q110: Durango and Verde formed a partnership with

Q111: Khalid, Dina, and James are partners with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents