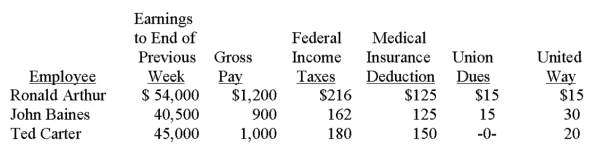

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Correct Answer:

Verified

Q118: Explain how to calculate times interest earned.

Q119: Classify each of the following items as

Q121: A company's income before interest expense and

Q123: Agro Depot's income before interest expense and

Q124: The tax rate for FICA-social security is

Q125: A company has 90 employees and a

Q126: A company's income before interest expense and

Q127: On December 1, Gates Company borrowed $45,000

Q149: Describe employer responsibilities for reporting payroll taxes.

Q178: What is a short-term note payable? Explain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents