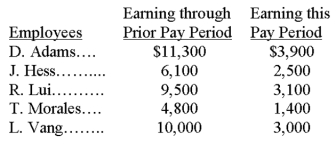

A company's employees had the following earnings records at the close of the current payroll period:

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $106,800 of earnings plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000. Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

Q145: Frado Company provides you with following information

Q146: The payroll records of a company provided

Q147: On January 31, Hale Company's payroll register

Q148: A company sells personal computers for $2,300

Q149: Helix Co. entered into the following transactions

Q151: All Star Sports receives $48,000,000 cash in

Q152: A company's payroll information for the month

Q153: A company's employer payroll tax rates are

Q154: Ember Co. entered into the following transactions

Q155: Halo Company provides you with following information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents