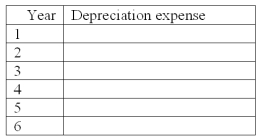

The Weiss Company purchased a truck for $95,000 on January 2. The truck was estimated to have a $3,000 residual value and a 4 year life. The truck was depreciated using the straight-line method. During the third year, it was obvious that the truck's total useful life would be 6 years rather than 4, and the residual value at the end of the 6th year would be $1,500. Determine the depreciation expense for the truck for the 6 years of its life.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: What are some of the variables that

Q141: On September 30 of the current year,

Q142: On July 1 of the current year,

Q143: Mahoney Company had the following transactions involving

Q145: A company purchased a machine for $75,000

Q146: A company purchased a truck on October

Q147: A company's property records revealed the following

Q148: On January 1, Year 1, Acadia purchased

Q149: On April 1, 2010, a company disposed

Q188: Explain how to calculate total asset turnover.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents