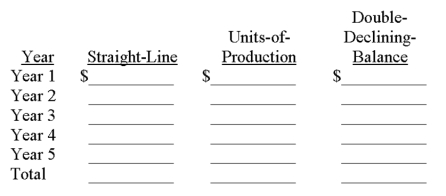

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a residual value of $75,000). During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Correct Answer:

Verified

Q174: A new machine is expected to produce

Q175: A company paid $314,000 for a machine

Q176: A company paid $770,000 plus $5,000 in

Q177: A company purchased a special purpose machine

Q178: A company made the following expenditures in

Q180: A company purchased equipment on July 3

Q181: Mason Company sold a piece of equipment

Q182: Record the following events and transactions for

Q183: The original cost of a machine was

Q184: Four main accounting issues for property, plant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents