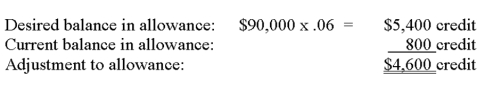

A company has $90,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. Experience suggests that 6% of outstanding receivables are uncollectible. The current credit balance (before adjustments) in the allowance for doubtful accounts is $800. The journal entry to record the adjustment to the allowance account includes a debit to Bad Debts Expense for $7,000.

Correct Answer:

Verified

Q53: The person who signs a note receivable

Q54: A credit sale of $3,275 to a

Q55: The matching principle requires that accrued interest

Q56: The accounting principle that requires financial statements

Q57: For legal reasons, it is always a

Q59: Notes receivable are classified as current liabilities.

Q60: A promissory note received from a customer

Q61: If the credit balance of the Allowance

Q62: The quality of receivables refers to:

A) The

Q63: On October 29 of the current year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents