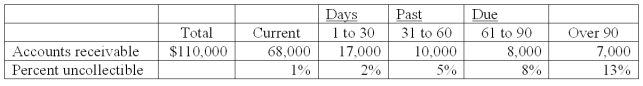

Loma Company estimates uncollectible accounts using the allowance method at December 31. It prepared the following aging of receivables analysis.

a. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $550 credit.

c. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $300 debit.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: Converting receivables to cash before they are

Q144: On April 30, Steinbeck Co. has $448,800

Q145: Myrex Corporation purchased $4,000 in merchandise from

Q146: _ is the charge for using (not

Q149: A _ is a signed promise to

Q152: The following data are taken from the

Q185: A supplementary record created to maintain a

Q209: _ are amounts owed by customers from

Q210: To write off an uncollectible account receivable

Q212: The accounts receivable turnover is calculated by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents