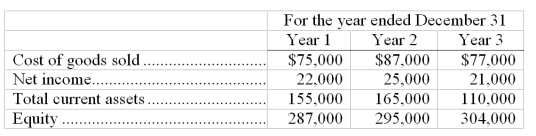

The City Store reported the following amounts on their financial statements for Year 1, Year 2, and Year 3:

It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

Correct Answer:

Verified

Q147: Explain the difference between the retail inventory

Q148: Using the information given below for a

Q149: A company made the following merchandise purchases

Q150: Advances in technology have greatly reduced the

Q151: Using the information given below, prepare general

Q153: A company reported the following data:

Required:

1. Calculate

Q154: Fast Auto Parts is an auto parts

Q155: A company made the following purchases during

Q156: Monitor Company uses the LIFO method for

Q157: A company made the following merchandise purchases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents