Based on the unadjusted trial balance for Bella's Beauty Salon and the adjusting information given below, prepare the adjusting journal entries for Bella's Beauty Salon.

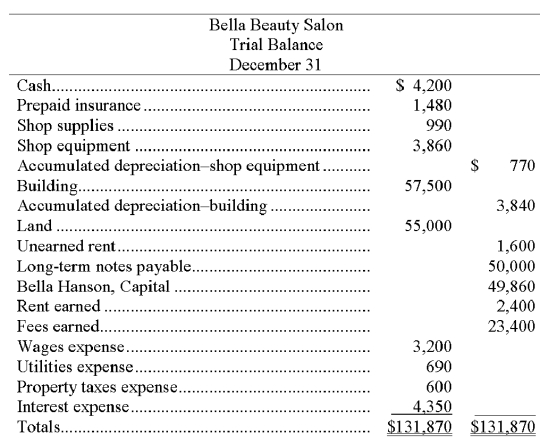

Bella Beauty Salon's unadjusted trial balance for the current year follows:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,220.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Correct Answer:

Verified

Q183: A company has 20 employees who each

Q184: On December 31, Connelly Company had performed

Q185: Prior to recording adjusting entries on December

Q186: In general journal form, record the December

Q187: During the current year ended December 31,

Q189: Prepare general journal entries on December 31

Q190: Complete the following by filling in the

Q191: Using the information given below, prepare an

Q192: Using the information presented below, prepare a

Q193: Western Company had $500 of store supplies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents