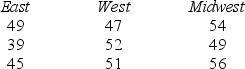

The Internal Revenue Service wishes to study the time required to process tax returns in three regional centers.A random sample of three tax returns is chosen from each of three centers.The time (in days) required to process each return is recorded as shown below.  The appropriate test to use to compare the means for all three groups would be

The appropriate test to use to compare the means for all three groups would be

A) test for independent samples.

B) one-factor ANOVA.

C) repeated two-sample test of means.

D) test for outliers.

Correct Answer:

Verified

Q42: Refer to the following partial ANOVA results

Q43: Given the following ANOVA table (some information

Q46: Using one-factor ANOVA with 30 observations,we find

Q48: Given the following ANOVA table (some information

Q49: Identify the degrees of freedom for the

Q50: Refer to the following partial ANOVA results

Q51: Refer to the following partial ANOVA results

Q52: For this one-factor ANOVA (some information is

Q54: In a one-factor ANOVA, the total sum

Q57: One-factor analysis of variance:

A)requires that the number

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents