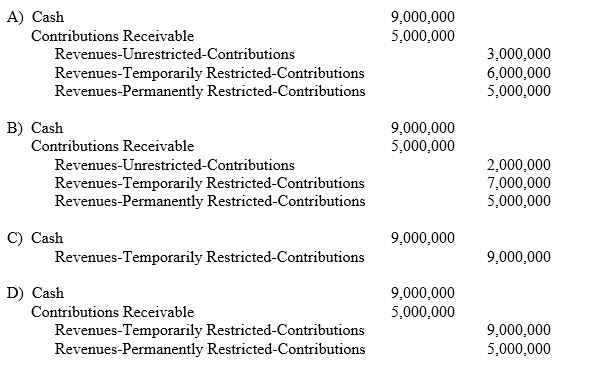

St. David's Hospital, a not-for-profit business oriented hospital, had contributions totaling $14,000,000 as follows: $2,000,000 for unrestricted purposes for the following year and beyond; $6,000,000 for construction of a new surgery wing which is scheduled to be built in the following year, $5,000,000 pledged for endowment purposes and $1,000,000 restricted for purposes other than long term asset acquisition. The endowment was a pledge; all other contributions were received in cash.

What is the hospital's journal entry?

Correct Answer:

Verified

Ratinal: The journal entry would be de...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: The difference between accounting for private not-for-profit

Q100: The difference between the financial statements of

Q101: Which of the following is NOT TRUE

Q102: Record the following transactions on the books

Q103: Which of the following is accurate with

Q105: Answer the following questions:

a) Other than a

Q106: Identify income items which should not be

Q107: What is the basis of accounting for

Q108: Assume you are reviewing the financial statements

Q109: The Audit and Accounting Guide identifies items

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents