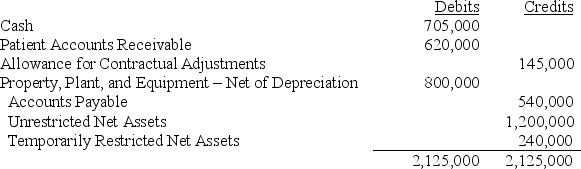

St. David's Hospital, a private not-for-profit, began the year 2017 with the following trial balance:

Transactions for 2017 are as follows:

a) Collected $340,000 of the Patient Accounts Receivable that was outstanding at 12-31-2016. Actual contractual adjustments on these receivables totaled $152,000.

b) The Hospital billed patients $2,350,000 for services rendered. Of this amount, 7% is expected to be uncollectible. Contractual adjustments with insurance companies are expected to total $792,000. Hint: use an allowance account to reduce accounts receivable for estimated contractual adjustments). The Hospital collected $1,235,000 of the amount billed to patients

c) In 2016 the Hospital had received a contribution of $240,000 to purchase new ultrasound equipment. The equipment was purchased for $300,000 in 2017.

d) Charity care in the amount of $60,000 at standard charges) was performed for indigent patients.

e) The Hospital received $700,000 in securities to establish a permanent endowment. Income from the endowment is unrestricted.

f) Other revenues collected in cash were: gift shop $11,000 and cafeteria $34,000.

g) The Hospital received in cash unrestricted interest income on endowments of $5,000. Unrealized gains on endowment investments totaled $7,000.

h) Expenses amounting to $1,160,000 for Professional Care of Patients, $340,000 for General Services, and $219,000 for Administration were paid in cash.

i) Depreciation on fixed assets, including the ultrasound equipment, totaled $125,000 for the year. $90,000 for Professional Care of Patients, $18,000 for General Services, and $16,000 for Administration.)

j) Closing entries were prepared.

Required:

A. Record the transactions described above.

B. Prepare in good form, a Statement of Operations for the year ended December 31, 2017

C. Prepare in good form, a Statement of Changes in Net Assets for the year ended December 31, 2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Identify income items which should not be

Q107: What is the basis of accounting for

Q108: Assume you are reviewing the financial statements

Q109: The Audit and Accounting Guide identifies items

Q110: It is the policy of St. David's

Q112: St. Paul's is a private not-for-profit hospital.

Q113: Which of the following organizations must follow

Q114: Investment income related to Assets Whose Use

Q115: Identify the three types of temporary restrictions

Q116: The Health Care Guide makes a distinction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents