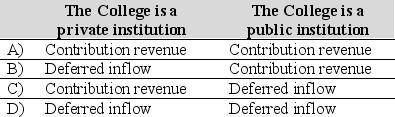

In December 2016, a donor to a college established a trust in which college receives $ 500,000 to be invested. The college receives $ 4,000 of the income per year until the donor dies. At that point, the assets revert to the donor's estate. The college estimates that the present value of the anticipated receipts from the trust amount to $ 120,000. How should this $ 120,000 be recorded in 2016, assuming

Correct Answer:

Verified

Ratinal: Private sector colleges reco...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: On December 1, 2016, a college received

Q95: Inflows from self-supporting operations by a private

Q96: With respect to public colleges and universities,

Q97: How should the following revenues be

Q98: Tuition and fees for Northern University were

Q100: Tuition and fees for Northern University were

Q101: Ballard University, a private not-for-profit, billed four

Q102: Record the following transactions on the books

Q103: Ethan Allen University is a private university

Q104: Southeastern State University, a public university, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents