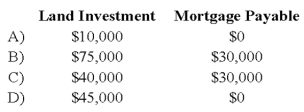

On December 31, 20X8, Mr. and Mrs. Williams owned a parcel of land held as an investment. The land was purchased for $40,000 in 20X6, and was encumbered by a mortgage with a principal balance of $30,000 at December 31, 20X8. On this date the fair value of the land was $75,000. In the Williams' December 31, 20X8, personal statement of financial condition, at what amount should the land investment and mortgage payable be reported?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q1: When is a partnership considered to be

Q2: According to UPA 1997,during partnership liquidation,loans the

Q5: The trial balance of WM Partnership is

Q10: The CRT partnership has decided to terminate

Q13: The balance sheet given below is presented

Q15: The trial balance of WM Partnership is

Q33: The trial balance of WM Partnership is

Q41: On a partner's personal statement of financial

Q48: On a partner's personal statement of financial

Q49: On a partner's personal statement of financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents