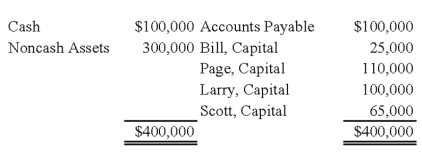

Bill, Page, Larry, and Scott have decided to terminate their partnership. The partnership's balance sheet at the time they decide to wind up is as follows:  During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

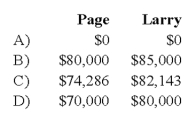

-Based on the preceding information, what amounts will be distributed to Page and Larry upon liquidation of the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q34: Partners Dennis and Lilly have decided to

Q35: In the computation of a partner's Loss

Q37: Partners Dennis and Lilly have decided to

Q43: Which of the following items are important

Q44: The partnership of Rachel, Adams, and Nixon

Q52: A partnership may be involved in "Dissociation"

Q54: Listen and Hear are thinking of dissolving

Q55: When a partnership is liquidated on a

Q56: Which of the following statements is (are)true?

I.In

Q56: The computation of a safe installment payment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents