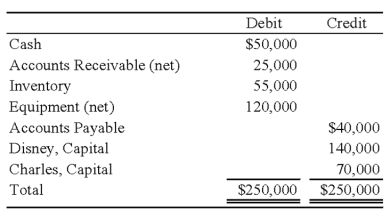

When Disney and Charles decided to incorporate their partnership, the trial balance was as follows:  The partnership's books will be closed, and new books will be used for D & C Corporation. The following additional information is available:

The partnership's books will be closed, and new books will be used for D & C Corporation. The following additional information is available:

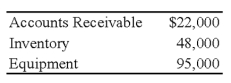

1. The estimated fair values of the assets follow:  2. All assets and liabilities are transferred to the corporation.

2. All assets and liabilities are transferred to the corporation.

3. The common stock is $5 par. Alice and Betty receive a total of 24,000 shares.

4. Disney and Charles share profits and losses in the ratio 6:4.

Required:

a. Prepare the entries on the partnership's books to record (1) the revaluation of assets, (2) the transfer of the assets to the D & C Corporation and the receipt of the common stock, and (3) the closing of the books.

b. Prepare the entries on D & C Corporation's books to record the assets and the issuance of the common stock.

Correct Answer:

Verified

Q37: Partners Dennis and Lilly have decided to

Q39: Bill, Page, Larry, and Scott have decided

Q41: Refer to the facts in Question 46.The

Q41: A personal statement of financial condition dated

Q44: The partnership of Rachel, Adams, and Nixon

Q46: The JKL partnership liquidated its business in

Q48: On March 1, 20X9, the ABC partnership

Q52: A partnership may be involved in "Dissociation"

Q54: Listen and Hear are thinking of dissolving

Q56: The computation of a safe installment payment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents