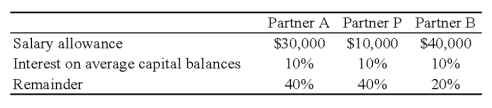

The APB partnership agreement specifies that partnership net income be allocated as follows:  Average capital balances for the current year were $50,000 for A, $30,000 for P, and $20,000 for B.

Average capital balances for the current year were $50,000 for A, $30,000 for P, and $20,000 for B.

-Refer to the information given. Assuming a current year net income of $50,000, what amount should be allocated to each partner?

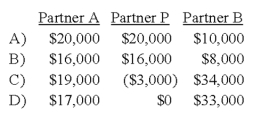

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q24: In the RST partnership,Ron's capital is $80,000,Stella's

Q28: When a partner retires from a partnership

Q35: Q38: When a new partner is admitted into Q39: When a new partner is admitted into Q40: In the RST partnership,Ron's capital is $80,000,Stella's Q41: In the AD partnership, Allen's capital is Q42: In the AD partnership, Allen's capital is Q43: Two sole proprietors, L and M, agreed Q59: In the AD partnership,Allen's capital is $140,000![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents