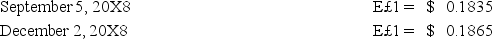

Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds on September 5,20X8,with payment due on December 2,20X8.Additionally,on September 5,Spartan acquired a 90-day forward contract to purchase 100,000 Egyptian pounds of E£ = $.1850.The forward contract was acquired to manage the exposed net liability position in Egyptian pounds,but it was not designated as a hedge.The spot rates were:

-Based on the preceding information,in the entry made on December 2nd to revalue foreign currency receivable to current equivalent U.S.dollar value,

A) Accounts Payable will be debited for $18,350.

B) Foreign Currency Units will be debited for $18,500.

C) Foreign Currency Transaction Gain will be credited for $150.

D) Other Comprehensive Income will be credited for $300.

Correct Answer:

Verified

Q21: Myway Company sold equipment to a Canadian

Q22: Myway Company sold equipment to a Canadian

Q23: On November 6,20X7,Zucor Corp.purchased merchandise from an

Q24: On December 5,20X8,Texas based Imperial Corporation purchased

Q25: Taste Bits Inc.purchased chocolates from Switzerland for

Q27: On November 1,20X8,Denver Company borrowed 500,000 local

Q28: Robert Company sold inventory to an Australian

Q29: Taste Bits Inc.purchased chocolates from Switzerland for

Q30: Levin company entered into a forward contract

Q31: Spartan Company purchased interior decoration material from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents