Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds on September 5, 20X8, with payment due on December 2, 20X8. Additionally, on September 5, Spartan acquired a 90-day forward contract to purchase 100,000 Egyptian pounds of E = $.1850. The forward contract was acquired to manage the exposed net liability position in Egyptian pounds, but it was not designated as a hedge. The spot rates were:

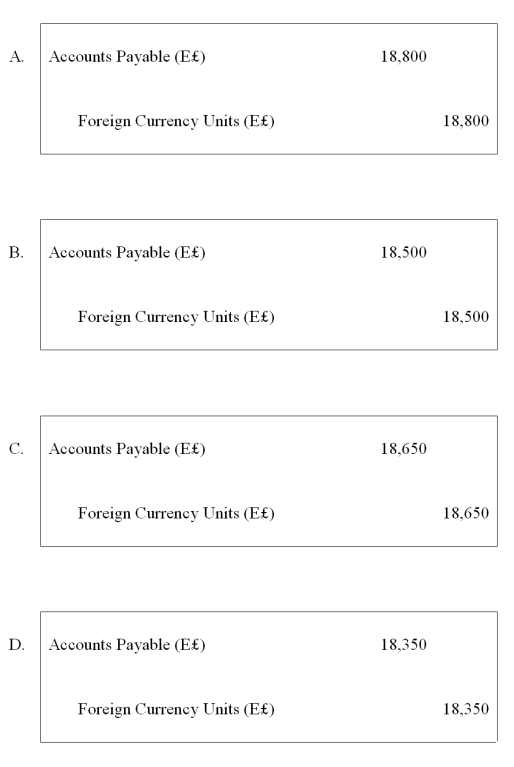

-Based on the preceding information, what is the entry required to settle foreign currency payable on December 2?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q2: On December 5, 20X8, Texas based Imperial

Q5: Chicago based Corporation X has a number

Q6: On December 5, 20X8, Texas based Imperial

Q6: Upon arrival in Chile,Karen exchanged $1,000 of

Q8: On March 1, 20X8, Wilson Corporation sold

Q9: Mint Corporation has several transactions with foreign

Q9: On September 3, 20X8, Jackson Corporation purchases

Q13: Suppose the direct foreign exchange rates in

Q26: Spartan Company purchased interior decoration material from

Q39: Company X denominated a December 1,20X9,purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents