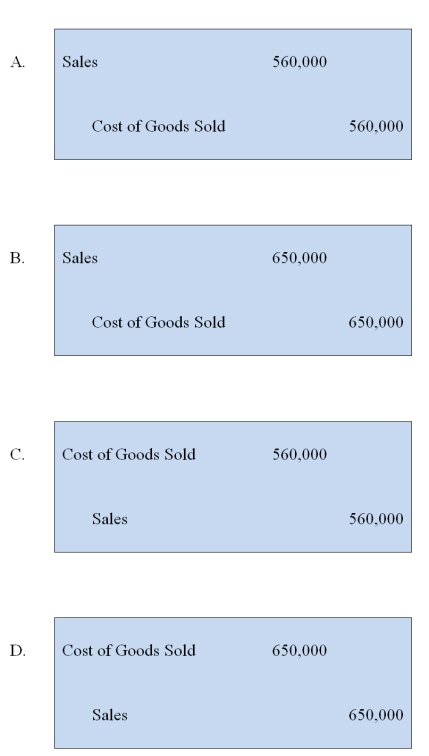

Global Corporation acquired 85 percent of Local Company's voting shares of stock in 20X7. During 20X8, Global purchased 50,000 picture tubes for $15 each and sold 28,000 of them to Local for $20 each. Local sold all of the units to unrelated entities prior to December 31, 20X8, for $30 each. Both companies use perpetual inventory systems.

Which worksheet eliminating entry is needed in preparing consolidated financial statements for 20X8 to remove all effects of the intercompany sale?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q2: When a parent and its subsidiary use

Q4: When there are intercompany sales of inventory

Q10: ABC Corporation owns 75 percent of XYZ

Q11: On January 1,20X8,Parent Company acquired 90 percent

Q13: Pluto Company owns 100 percent of the

Q15: Consolidated net income may include the parent's

Q16: Perth Corporation owns 90 percent of Sydney

Q21: Pepper Corporation owns 75 percent of Salt

Q25: Pepper Corporation owns 75 percent of Salt

Q27: Pepper Corporation owns 75 percent of Salt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents