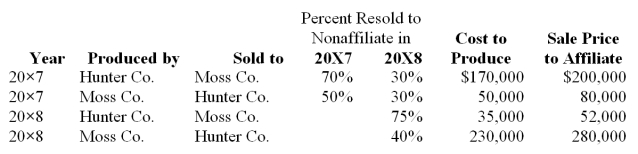

Hunter Company and Moss Company both produce and purchase fabric for resale each period and frequently sell to each other. Since Hunter Company holds 80 percent ownership of Moss Company, Hunter's controller compiled the following information with regard to intercompany transactions between the two companies in 20X7 and 20X8:  Required:

Required:

a. Give the eliminating entries required at December 31, 20X8, to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b. Compute the amount of cost of goods sold to be reported in the consolidated income statement for 20X8.

Correct Answer:

Verified

Q41: Colton Company acquired 80 percent ownership of

Q42: On January 1, 20X7, Jones Company acquired

Q43: On January 1, 20X7, Jones Company acquired

Q44: Pisa Company acquired 75 percent of Siena

Q47: On January 1, 20X7, Jones Company acquired

Q49: Pisa Company acquired 75 percent of Siena

Q50: Pisa Company acquired 75 percent of Siena

Q55: Elvis Company purchases inventory for $70,000 on

Q59: Padre Company purchases inventory for $70,000 on

Q60: Padre Company purchases inventory for $70,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents