Pisa Company acquired 75 percent of Siena Company on January 1, 20X3 for $712,500. The fair value of the noncontrolling interest was equal to 25 percent of book value. On the date of acquisition, Siena had common stock outstanding of $300,000 and a balance in retained earnings of $650,000. During 20X3, Siena purchased inventory for $35,000 and sold it to Pisa for $50,000. Of this amount, Pisa reported $20,000 in ending inventory in 20X3 and later sold it in 20X4. In 20X4, Pisa sold inventory it had purchased for $40,000 to Siena for $60,000. Siena sold $45,000 of this inventory in 20X4.

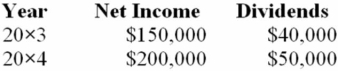

Income and dividend information for Siena for 20X3 and 20X4 are as follows:  Pisa Company uses the fully adjusted equity method.

Pisa Company uses the fully adjusted equity method.

Required:

a. Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X3.

b. Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X4.

Correct Answer:

Verified

Q40: Push Company owns 60% of Shove Company's

Q41: Colton Company acquired 80 percent ownership of

Q42: On January 1, 20X7, Jones Company acquired

Q43: On January 1, 20X7, Jones Company acquired

Q47: On January 1, 20X7, Jones Company acquired

Q48: Hunter Company and Moss Company both produce

Q49: Pisa Company acquired 75 percent of Siena

Q55: Parent Corporation owns 90 percent of Subsidiary

Q59: Padre Company purchases inventory for $70,000 on

Q60: Padre Company purchases inventory for $70,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents