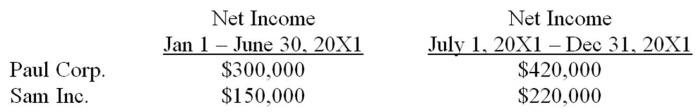

Paul Corp. acquired 100 percent of Sam Inc.'s voting stock on July 1, 20X1. The following information was available as of December 31, 20X1:  How much net income should be reported in Paul Corp's income statement for 20X1?

How much net income should be reported in Paul Corp's income statement for 20X1?

A) $370,000

B) $720,000

C) $940,000

D) $1,090,000

Correct Answer:

Verified

Q22: The fair value of net identifiable assets

Q27: Plummet Corporation reported the book value of

Q31: Following its acquisition of the net assets

Q35: Public Equity Corporation acquired Lenore Company through

Q38: Following its acquisition of the net assets

Q42: On January 1, 20X8, Alaska Corporation acquired

Q47:

Pursuing an inorganic growth strategy, Wilson Company

Q48: Which of the following observations concerning "goodwill"

Q48: The length of the measurement period allowed

Q58:

Pursuing an inorganic growth strategy, Wilson Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents