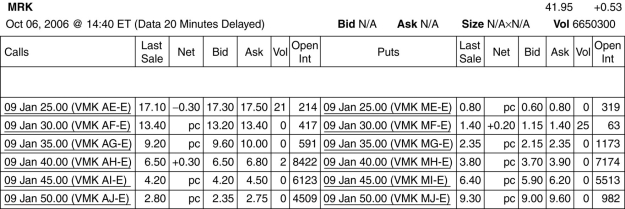

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume you want to buy one options contract that with an exercise price closest to being at-the-money and that expires January 2009. The current price that you would have to pay for such a contract is ________.

A) $680

B) $380

C) $650

D) $420

Correct Answer:

Verified

Q8: The holder of a put option has:

A)the

Q9: Using options to place a bet on

Q18: Using options to reduce risk is called:

A)speculation.

B)a

Q23: Use the table for the question(s) below.

Consider

Q24: What is a put option?

Q28: Use the table for the question(s) below.

Consider

Q29: Use the table for the question(s) below.

Consider

Q30: Use the table for the question(s) below.

Consider

Q31: When is an option in-the-money?

Q32: When is an option out-the-money?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents