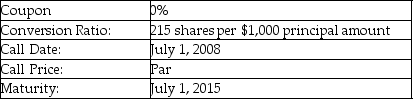

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $4.70. If the bonds are called on this date, which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A) Convert the bond and accept shares with a value of $10,000.

B) Convert the bond and accept shares with a value of $9599.75.

C) Convert the bond and accept shares with a value of $10,105.00.

D) Accept the call price and receive $10,000.

Correct Answer:

Verified

Q61: A company issues a callable (at par)

Q63: A company issues a callable (at par)

Q64: Q70: Supreme Industries issues the following announcement to Q71: A company issues a callable (at par)![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents