Multiple Choice

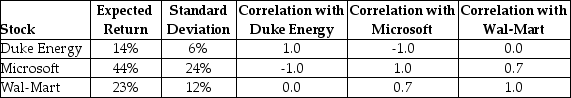

Consider the following expected returns, volatilities, and correlations:

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

A) 4.0%

B) 0.7%

C) 6.7%

D) 20.1%

Correct Answer:

Verified

Related Questions

Q24: When we form an equally weighted portfolio

Q37: What role does the correlation of two

Q42: Which of the following equations is INCORRECT?

A)

Q42: A stock market comprises 2100 shares of