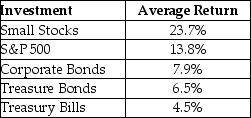

Consider the following average annual returns:

What is the excess return for the S&P 500?

A) 11.5%

B) 16.3%

C) 0%

D) 9.3%

Correct Answer:

Verified

Q54: Which of the following statements is FALSE?

A)Expected

Q61: Is volatility a reasonable measure of risk

Q66: Is volatility a reasonable measure of risk

Q70: A portfolio of stocks where each stock

Q72: Historical evidence on the returns of large

Q74: Consider the following average annual returns:

Q75: Consider the following average annual returns:

Q76: A portfolio of stocks can achieve diversification

Q79: Which of the following statements is FALSE?

A)

Q80: When looking at investment portfolios historically, was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents