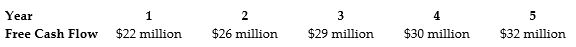

General Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 9% and General Industries has cash of $15 million, debt of $45 million, and 80 million shares outstanding, what is General Industries' expected current share price?

General Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 9% and General Industries has cash of $15 million, debt of $45 million, and 80 million shares outstanding, what is General Industries' expected current share price?

A) $7.78

B) $8.17

C) $9.34

D) $11.67

Correct Answer:

Verified

Q3: Gonzales Corporation generated free cash flow of

Q4: On a particular date, FedEx has a

Q6: If you want to value a firm

Q10: Use the table for the question(s) below.

Q12: Which of the following is the appropriate

Q13: What additional adjustments are required to find

Q16: The discounted free cash flow model ignores

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents